Warren Buffett’s Berkshire Hathaway just reported second-quarter operating earnings of $11.16 billion — a slight 4% dip compared to last year. The modest decline was driven by lower insurance underwriting profits, even as other divisions like railroads, energy, retail, and manufacturing posted solid gains.

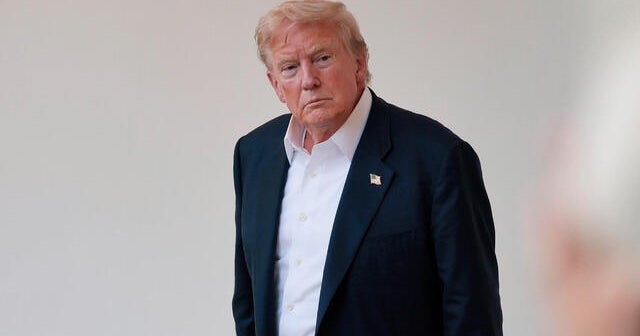

But what really stood out wasn’t the numbers — it was the tone. In its official filing, the company warned that President Trump’s newly imposed tariffs on goods from Mexico, Canada, and China pose a real threat to its businesses.

“It is reasonably possible there could be adverse consequences on most, if not all, of our operating businesses,” Berkshire wrote in its Q2 earnings report.

Buffet put it more bluntly and called tariffs “an act of war, to some degree,” in a recent interview with CBS’s Norah O’Donnell.

“Over time, they are a tax on goods. I mean, the tooth fairy doesn’t pay ’em! And then what? You always have to ask that question in economics. You always say, ‘And then what?’”

While tariffs are framed as penalties on foreign countries, they often raise prices for American businesses and consumers. If it costs more to import steel, electronics, or groceries, someone pays — and usually, it’s you.

Buffett has long warned about how trade restrictions can:

The latest moves by the Trump administration — including a proposed $250 visa fee for some international travelers and limitations on tax deductions for gambling losses — are already affecting tourism, manufacturing, and agriculture. Buffett’s companies touch all those sectors, so his concern isn’t theoretical.

Despite the cautionary tone, Berkshire is still immensely profitable and liquid. The firm ended the quarter with $344 billion in cash, slightly down from its record $347 billion earlier this year. But instead of spending, Buffett is holding back:

Buffett seems to be waiting for better deals, or maybe bracing for a correction.

Read more: Nervous about the stock market in 2025? Find out how you can access this $1B private real estate fund (with as little as $10)

Berkshire also recorded a $3.8 billion loss on its long-troubled Kraft Heinz investment, which is reportedly weighing a grocery spinoff to revive growth. Two Berkshire directors resigned from the Kraft Heinz board earlier this year, suggesting waning confidence.

And despite shares falling more than 10% from a record high, Berkshire didn’t repurchase any of its own stock — a sign the firm may be anticipating more room to fall.

You don’t need to own Berkshire stock to pay attention to this report. Berkshire’s cautious tone, especially around tariffs, should resonate with everyday Americans. Tariffs will lead to higher prices — whether it’s appliances, electronics, or groceries, expect price hikes if trade tensions escalate.

Buffett’s warnings point to a ripple effect for everyday Americans:

-

Higher prices on goods imported from key trade partners

-

Potential job losses in manufacturing and agriculture due to retaliatory tariffs

-

More market volatility as investors respond to global trade uncertainty

Food inflation may also stick around. Kraft Heinz’s struggles reflect challenges across the grocery industry: high input costs, changing consumer tastes, and pressure to spin off underperforming brands.

Buffett and Berkshire Hathaway aren’t alone with their concerns. Other CEOs and economists have voiced concern that new trade barriers could hamper economic recovery just as inflation is cooling and interest rates are stabilizing.

Even with billions in profit and an army of businesses, Buffett’s Berkshire Hathaway is waving a red flag about the state of the economy.

And when the “Oracle of Omaha” is cautious, it’s smart to listen. Keep an eye on policy, not just profits.

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.